Last year, total sales reached £13.3bn, up more than 7% year-on-year. This year promises to be even better, with falling interest rates, an easing cost-of-living crisis and rising wages all contributing to stronger consumption.

The consumer sector has been a tough place for investors over the past few years. The MSCI Consumer Staples Index has delivered less than half the return of the wider MSCI World Index over the past 12 months.

Discretionary spending has fared marginally better, supported by companies such as Amazon and Tesla, but the S&P 500 Consumer Discretionary Index is still some way behind the wider S&P 500.

The reasons for the weakness have been multifaceted, but inflation has played an outsized role. It has eaten into consumers’ spending power and confidence, leaving little room for extras. In the UK, the pandemic has changed spending habits, with households saving more than they have at any point in recent history.

But there are signs of a change. Falling inflation, lower interest rates and higher wages are all improving household finances, leaving more cash to spend on air fryers, gaming consoles or whatever else takes consumers’ fancy on Black Friday. This is increasingly being seen in the performance of retailers. M&S, for example, has seen a 68% rise in its share price over the past year.

Wellness and wellbeing holidays: Travel insurance is essential for your peace of mind

Out of the pandemic lockdowns, there’s a greater emphasis on wellbeing and wellness, with

Sponsored by Post Office

However, it remains a tough and competitive sector and needs to be navigated carefully. Fund managers are backing certain retailers to do well. The Artemis Income Fund, for example, has significant weightings in Next and Tesco.

Adrian Frost, manager of the fund, says: “Tesco’s strong value proposition continues to appeal to all customers, from the most affluent to least well-off. This has helped the company to drive market share gains from an already dominant position. The latest industry data suggests Tesco’s market share of UK grocery is almost 28%, nearly double the share of second place Sainsbury’s.”

Next has also come a long way from its high-street retail days. It has been absorbing brands such as FatFace, Joules, Made.com, Cath Kidston and JoJo Maman Bébé. It has a major stake in Reiss and the UK division of Victoria’s Secret. Chief executive Simon Wolfson leads one of the most skilled and experienced management teams in the city.

The AI influence

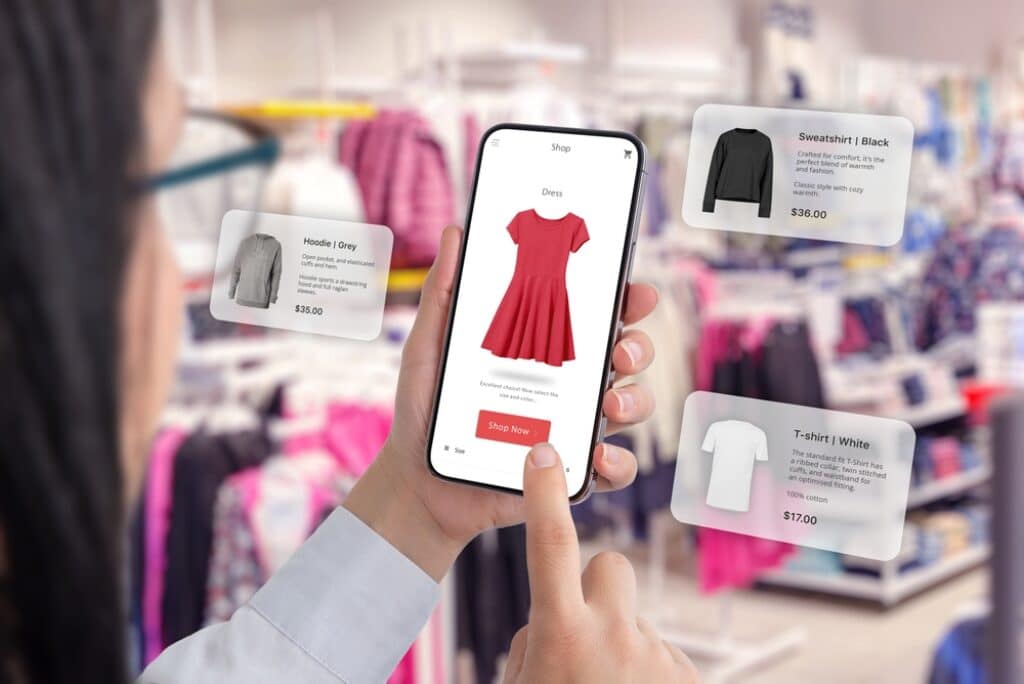

Artificial intelligence (AI) is starting to play a more important role in retailing, and this is also creating opportunities. Black Friday is an increasingly online phenomenon. Over 90 million people in the US shopped online on Black Friday 2023, and 64% of customers intend to shop online in 2024. AI is helping to drive online sales, through personal recommendations and promotions.

The Baillie Gifford American Fund holds companies such as Amazon and Shopify, which are plugged into this trend. Manager Gary Robinson says of Spotify: “This is an e-commerce tools business, run by a technical product-orientated founder called Tobias Lutke. It has massive amounts of data, collected on the back of the two million merchants that use its platform.”

He says that Lutke is increasingly excited about the potential for generative AI to drive sales at the business.

Amazon has more to its business than just online shopping. Almost 20% of its revenues come from its cloud computing business Amazon Web Services (AWS). It also has digital advertising, plus revenues from Alexa devices, Kindle e-reader, Fire TV, plus Amazon Prime. It is currently 7.5% of the Baillie Gifford American Fund.

There are also companies harnessing AI closer to home. Greeting cards may feel like they disappeared with the ark – who can forget the disappearance of Clinton Cards from high streets around the country – but there are winners in this part of the market. Online card business Moonpig, for example, has been a significant beneficiary of AI, which has helped it generate more sales from its customer base. It has also seen real growth in its subscription service.

Moonpig is a holding for a number of UK smaller companies funds, including TM Tellworth UK Smaller Companies Fund. The fund is 24% invested in consumer discretionary businesses.

Alongside Moonpig, the group also holds its ‘in real life’ competitor Card Factory. Unlike Moonpig, Card Factory’s share price has been very weak, even though recent trading updates have been robust. Manager Paul Marriage has been sticking with it in the hope of a recovery.

There are plenty of opportunities in retail and AI is helping good companies do better. It is a sector where it is important to be selective, but there are growing tailwinds for the consumer in the year ahead.

Darius McDermott is managing director of FundCalibre and Chelsea Financial Services