The department chain has launched a new interest-bearing credit plan on purchases between £200 and £25,000, bought in stores, via app or online.

This means customers will now have a choice of two payment options, with the long-running interest-free credit option still available on the same product categories.

For those wanting to spread the cost of purchases over a longer period of time, the interest-bearing credit plan comes with a 16.9% APR representative rate.

For in-store shopping, customers need to ask at the till, while online, once eligible items have been added to the basket, both the 0% APR and credit option will be displayed.

To be eligible for credit, you need to have an annual income of £10,000 or more. But John Lewis said it will consider joint income if you’re either married, living with a partner or in a civil partnership, as well as those in receipt of Disability Allowance, Employment and Support Allowance, or Personal Independence Payment.

Wellness and wellbeing holidays: Travel insurance is essential for your peace of mind

Out of the pandemic lockdowns, there’s a greater emphasis on wellbeing and wellness, with

Sponsored by Post Office

Shoppers will need to complete a soft credit check (which won’t show up on credit history) and full credit application for the finance option.

John Lewis said the total amount payable over the period (12, 24, 36, and up to 48 months on big ticket items) will be clearly displayed to ensure customers make an informed choice.

Customers can pay over a variety of monthly terms depending on the product purchased.

For instance, for home and nursery purchases on credit, here are the thresholds:

- £200 to £499.99: repayment period for 12 months

- £500 to £1,249.99: repayment period for 24 months

- £1,000 to £25,000: repayment period for 36 months

A big ticket item such as a fitted kitchen or a garden building would see customers offered up to 48 months to repay the cost.

For electrical items, spends between £200 and £25,000 can be spread over 24 or 36 months.

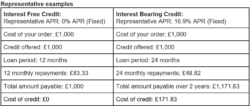

The table below shows the representative examples from both the 0% APR and credit option (click to expand):

John Lewis confirmed to YourMoney.com that warranty terms are not impacted by the payment plan. It will still end after the two-year period for electricals or five-year period for TVs.

Andy Piggott from John Lewis Finance said: “We’re seeing more of our customers choosing our Interest Free Credit payment plan. For those who want lower payments over a longer period of time, the introduction of interest-bearing credit offers customers more choice – helping them find the right plan to suit their circumstances.”