Investing

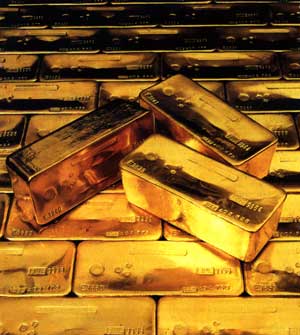

Gold price falls below $1,200 for first time since 2010

The price of gold has continued its decline, falling below the $1,200 mark on Thursday for the first time since August 2010.

It has dropped some 34% since its peaks in August 2011, when an ounce was worth $1,895, and is down 23% over the year-to-date.

This significant fall has caused the value of the Bank of England’s reserves to plummet to £8.2bn, down from £12.4bn in August 2011, according to calculations by Banc De Binary, an options trading firm.

Investors have viewed gold as a safe haven asset and protection against potential increases in inflation, but recent noise from the US Federal Reserve has undermined its attractiveness.

The Fed said last week it may “taper” its bond-buying programme in the coming months if the local economy continues to recover.

The announcement caused a wide sell-off in gold assets, as investors rushed to get out ahead of further price deterioration.

Wellness and wellbeing holidays: Travel insurance is essential for your peace of mind

Out of the pandemic lockdowns, there’s a greater emphasis on wellbeing and wellness, with

Sponsored by Post Office

Gold prices have had a remarkable run over the past few years, driven by the slump in the global economy and historically low interest rates across the globe.