Investing

Investors pump record sums into ETPs

The commodities market is being hit hard as investors pump record sums into exchange traded products, in a bid to avoid the increasing volatility caused by fears over the global economy.

Inflows into ETPs, which mainly offer exposure to baskets of equities, bonds or commodities, attracted net assets of more than $100bn in the first half of this year – making it the highest amount since the industry emerged in the late 1980s, according to BlackRock’s ETP Landscape team. The global ETP industry now stands at $1.68tn.

There is a strong demand for exposure to income-producing assets, with fixed-income ETPs being the main contributor to inflows rising to $1.5bn, a 16% increase from the same period last year.

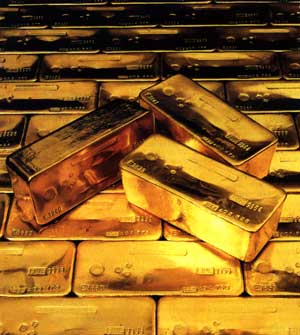

Gold ETPs particularly benefitted from increased inflows as investors expect central banks to take further steps to boost growth by loosening monetary policy today. Gold ETPs gathered $2.2bn in new assets.

Dodd Kittsley, global head of ETP research for BlackRock, commented: “The ETP industry continues to gather new assets from investors around the world, who are attracted by the efficient market access ETPs can offer.”

“Demand for exposure to fixed income assets has been a key theme for the last year and shows no sign of abating, as acceptance of the value of an indexed approach to fixed income investing gains increasing traction amongst investors. During times of economic uncertainty and increased market volatility, the efficiencies, precision and flexibility that ETPs may offer tends to resonate with investors.”

Wellness and wellbeing holidays: Travel insurance is essential for your peace of mind

Out of the pandemic lockdowns, there’s a greater emphasis on wellbeing and wellness, with

Sponsored by Post Office

June was the eighteenth consecutive month in which global fixed income ETPs have attracted net inflows. Other income-focused ETPs, including those providing exposure to high dividend equities, real estate and preferred stocks drew in $17.9bn on a year to date basis.

Developed market equity ETPs also saw inflows during the same month, mostly from U.S. investors, posting net new assets of $12.7bn. On a year to date basis, developed market equity ETPs have gathered inflows of $40.5bn whilst developed market equity mutual funds have seen outflows of $66bn according to EPFR.