Household Bills

Tuesday newspaper round-up: BHP Billiton, Pay-outs, Energy bills

BHP Billiton to increase iron ore production; energy bills will top £1,500 after new price hikes; dividend payouts set to hit £100bn for the first time.

BHP Billiton is in demand this morning after the Australian miner said it was lifting its full-year iron ore production forecast due to resurgent demand in China. The miner’s shares have risen 1.7 per cent after it said it now expects to produce 212mn tonnes of iron ore this financial year against previous guidance of 207mn tonnes. In its quarterly report to shareholders, BHP also said iron ore production had risen a healthy 23 per cent compared to the same period last year, the Financial Times says.

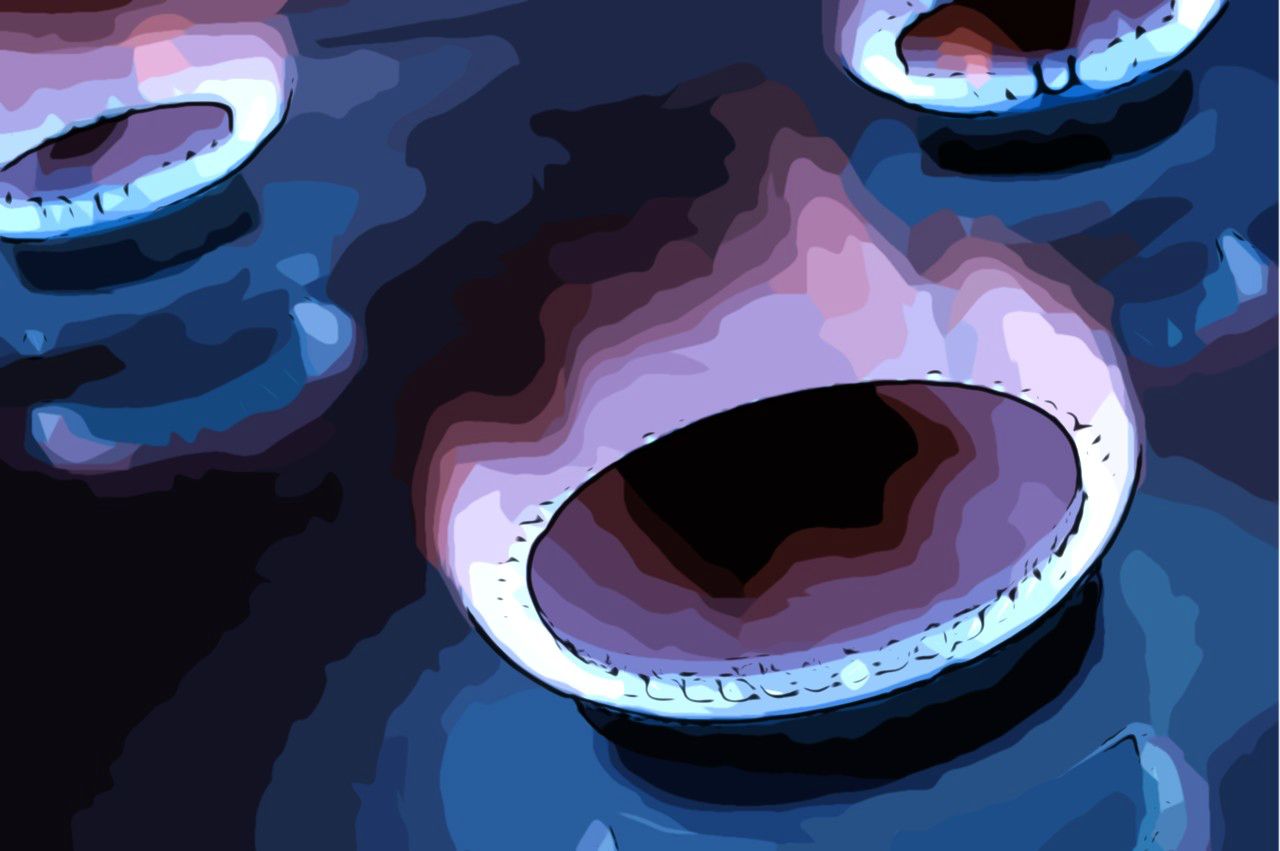

Energy bills will top £1,500 for the first time after npower became the latest supplier to announce an inflation-busting price rise. The company is increasing gas and electricity bills by 10.4% on average, adding almost £140 to the annual cost of heating and lighting a home. Campaigners accused the company of putting “profits before people’s lives”. The increase by the German-owned supplier came as the Government faced criticism for awarding subsidies worth tens of billions of pounds to a French company to build Britain’s first nuclear power plant in a generation, according to The Times.

The expected £16.6bn special dividend from Vodafone, following the sale of its stake in US group Verizon Wireless, will take pay-outs by UK stock market listed firms past £100bn for the first time. It easily outstrips the previous high of £80.6bn in 2012. Even without the mammoth windfall from Vodafone, pay-outs to private investors and institutional shareholders such as pension funds are set to hit £83bn next year, The Daily Express says, citing data from the Shareholder Solutions unit at Capita Asset Services.

Former employees of ICAP, Rabobank, the Royal Bank of Scotland, Deutsche Bank and UBS were among 22 names that the UK Serious Fraud Office included as alleged co-conspirators on a draft indictment against Tom Hayes, a former star trader at both UBS and Citigroup who is facing criminal charges stemming from a probe into alleged LIBOR manipulation. None have been formally accused of wrongdoing by the fraud agency but may face investigation, according to a copy of an SFO letter read out by Mr Justice Cooke during a hearing at London’s Southwark Crown Court on Monday, the Financial Times writes.

Wellness and wellbeing holidays: Travel insurance is essential for your peace of mind

Out of the pandemic lockdowns, there’s a greater emphasis on wellbeing and wellness, with

Sponsored by Post Office