Blog

‘I’m one of Chase’s one million UK customers – here’s my take on it’

I joined Chase in May and have made the most of my account over the last few months, including overseas. As Chase has notched up one million UK customers, I wanted to share my experience.

US banking giant JPMorgan Chase launched its UK bank account in September 2021 offering 5% interest on round-up spending as well as 1% cashback for 12 months on debit card spending.

Another big attraction is its fee-free status for overseas use – including ATM withdrawals.

But what really drew me in was the launch of its easy access account paying 1.5%. Back in March 2022 (before all these rate hikes) that was market-leading.

Even though customers had to open its current account to get the deal, there was no requirement to close existing everyday banking services which suited me.

By covering personal finance, experts were sharing their tips with our readers telling them not to hang around as deals – especially market-leading ones – could close at any time.

Wellness and wellbeing holidays: Travel insurance is essential for your peace of mind

Out of the pandemic lockdowns, there’s a greater emphasis on wellbeing and wellness, with

Sponsored by Post Office

Although I was a little nervous around the app-only concept, I signed up and the process was straight forward, though it required a steady hand to photograph documents.

I was also lucky to get in ahead of the thousands of customers in the Chase waiting room as it dealt with a backlog of complaints and warned of an up to five-week wait.

Eager to start earning cashback

Heading to the shops with my new card (which I could decide how my name appeared on it), I was eager to start earning cash back.

But after my card was declined a couple of times, I realised it’s not the same as my other banking debit cards. I actively had to move my cash for it to sit in the account ready to use – it wasn’t an automatic link.

Once over that hurdle, I find I’m using my Chase card everywhere that I don’t earn cashback with alternative credit or debits cards or where I don’t earn rewards or points for spending at certain retailers.

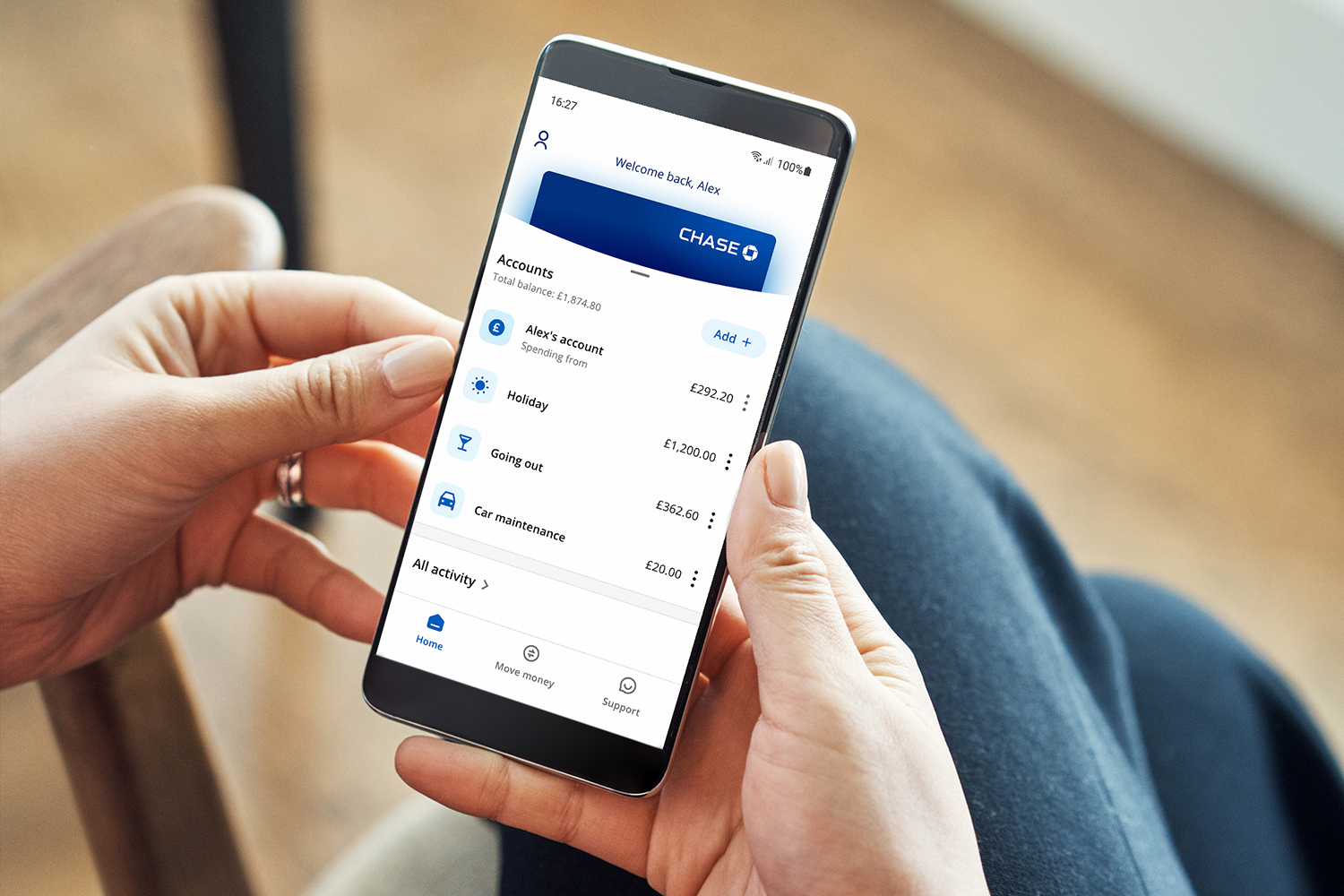

As the debit card itself doesn’t include any account numbers, what I really like about the Chase app is that there’s a well-thought out function that lets you copy and paste your long card number, expiry date and security code which saves times when buying online. It also doesn’t log you out of the app if you come out of it say to do your online shopping.

However, one draw back is that you have to activate the round-up feature to earn the 5% interest. It would be more consumer-friendly to have this automatically set up for customers.

Meanwhile the app is easy to use and easy to see all your accounts and savings, as well as the cashback earnt.

No problem overseas spending

Travelling to Europe this summer, I relied on Chase for petrol and food transactions and despite my nervousness, all worked fine. There were no blips, outages or blocks…I didn’t even need to inform Chase about my overseas trip.

Another handy (or frightening) feature is that Chase compares your money coming in and out of the current month versus the previous month.

But on the plus side, it’s nice to see all my round-up change earning 5% interest, so it’s no wonder a million UK customers are now signed up.

According to Chase data, customers have an average of £27,000 in their saver account, compared to the national average for savings of £23,000.

On round-ups, customers save an average of £13 each month and the top three transaction categories for customers earning cashback with their debit card is on grocery and supermarket shopping, restaurants and fast-food outlets and public transport.

The top five countries where customers are spending their money include United States, Ireland, France, Spain and the Netherlands.

‘Just the beginning’

Chase said it is planning to introduce a “broad range of banking products for UK customers” which will include new features and enhancements to the Chase current account, new savings options, and lending products such as a Chase credit card.

Sanjiv Somani, UK CEO of Chase and Nutmeg, said: “We set out to offer customers good value banking products with a straightforward experience delivered through an easy to use app, and we’re excited that consumers have responded so positively to our offer in our first year.

“This is just the beginning and, as we broaden our product offering and fully integrate the investment products offered by Nutmeg, we look forward to playing a wider role in the financial lives of our customers in the future and supporting the communities we serve.”

Let’s hope Chase can continue to deliver for the UK market.

Paloma Kubiak is editor of YourMoney.com